Sunak claims that the recently unveiled UK Battery Strategy is part of HMG "going full throttle" to back UK business. However, as Kemi Badenoch acknowledges, the US and other countries are already grabbing market share through state subsidies. Once those plants are on the ground they will be had to compete against. "Full throttle" this ain't. Reposted from Edie.

The Battery Strategy was published on Sunday (26 November), ahead of a major meeting of international investors hosted by Prime Minister Rishi Sunak on Monday (27 November).

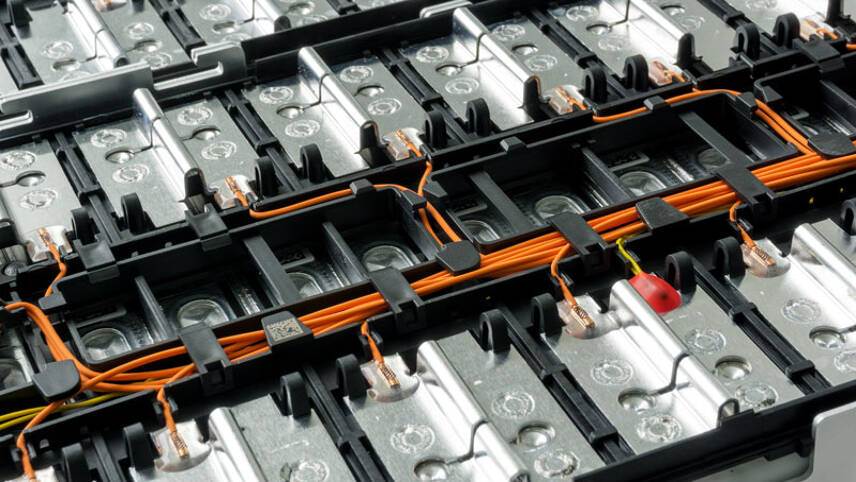

It seeks to allay concerns about the UK falling behind in the global race to scale supply chains and manufacturing capacity for batteries necessary for the net-zero transition – whether they are those found in electric vehicles (EVs) or those used in grid-scale energy storage projects.

Business and Trade Secretary Kemi Badenoch has stated that while markets like the US have “embarked on large tax and spending sprees to claim a share of the global market”, her team will not allow the UK to be “drawn in to a distortive subsidy strategy”.

“For those of us who believe in the power of the market, the key to unlocking continued growth in our manufacturing industry is capital investment from the private sector, which sustains jobs and growth for the UK,” Badenoch added in her foreword to the Strategy document.

The Strategy stipulates that the UK Government expects to leverage £5 of private investment for every £1 of spending from public sources. In terms of public spending, the Strategy promises more than £60m of new funding, including:

- An additional £38m for the UK Battery Industrialisation Centre, which focuses on research and innovation

- An additional £12m for the new Advanced Materials Battery Industrialisation Centre, set up to bridge the gap between research and commercialization

- An additional £11m for the Faraday Challenge, to support innovators

- £20m for a new proof-of-concept scheme to develop a pathway for scaling university spin-outs

- Further “sustained, consistent and targeted support” for specific projects across the whole value chain, on a case-by-case basis

The Strategy document reiterates the £2bn package that was already confirmed to support the automotive manufacturing sector’s net-zero transition ahead of last week’s Autumn Statement. This funding is to be spent between 2025 and 2030.

The funding is being allocated to support a three-pronged strategy covering designing new technologies; building out supply chains and manufacturing capacity; and sustaining future growth through skills planning and collaboration.

As well as direct funding, the Strategy stipulates changes to the tax relief system for research-intensive SMEs, due to take effect in April 2024. SMEs will be able to allocate 40% of their investment to R&D, up from 30%, and still claim an enhanced rate of relief.

The Strategy additionally sates that the Government will commence exploratory work on new R&D centres, co-located with EV manufacturing hubs, next year.

It will also consult on new rules and guidelines for end-of-life battery management. This process can hopefully begin before the general election.

Advanced manufacturing plan

Alongside the Battery Strategy, the Department for Business and Trade also published an Advanced Manufacturing Plan.

A new critical imports and supply chains strategy, to support both the Advanced Manufacturing Plan and Battery Strategy, has been promised “shortly”.

The Advanced Manufacturing Plan provides more details on the measures announced before and during the Autumn Statement, including:

- A total of £4.5bn of Government spending on manufacturing, to be spent from 2025

- The full expensing scheme being made permanent, enabling businesses to claim back relief for spending on certain kinds of new equipment

- An extension of the Made Smarter scheme

- £300m in annual tax relief for businesses meeting energy efficiency requirements under a new six-year Climate Change Agreement scheme

- An extension to the Industrial Energy Transformation Fund backed with £185m

In terms of new information, the plan pledges £50m from Westminster coffers for a new two-year programme to develop new apprenticeships for careers in low-carbon manufacturing.

This will feed in to a new skills strategy, which is due in early 2024 and will have green jobs as the primary focus. The UK Government has long been called upon to update its strategic education and skills plans after legislating for net-zero by 2050 in 2019.

Also in early 2024, the plan states, the Government will publish a roadmap detailing plans to scale the UK’s solar generation capacity to 70GW by 2035. The roadmap will be based on the work of the solar industry taskforce set up earlier this year and, given the Government’s reservations about expanding solar on farmland, is expected to contain much detail on scaling onsite solar on commercial and industrial buildings like warehouses and factories.

On the topic of taskforces, the Plan confirms the launch of a new hydrogen taskforce to assess the best delivery pathway for meeting the UK’s 2030 hydrogen production target. The Government is targeting 10GW of low-carbon manufacturing capacity by the end of the decade, at least half of which should be renewable. The new taskforce should publish its initial recommendations in spring 2024.

Announcing the Plan, Sunak said: “We are going full throttle to back British businesses and make the UK a world leader in manufacturing – which already makes up over 43% of all our exports and employs 2.6 million people across the country.

“Today’s plan will not only give the industry the long-term certainty they need to grow and invest further in the UK, but it will also lay the foundations to create more jobs and opportunities for people across the country.”

Labour has said that the Plan is not sufficient to make up for past missed opportunities to invest strategically in low-carbon manufacturing.

“The past 13 years of Conservative government has been marked by a complete lack of stability, consistency and ambition which has turned potential investors away from Britain,” said Jonathan Reynolds, shadow trade and business secretary.